-

Bahraini Group Plans to Upgrade Islamic Finance Regulations

April 26, 2017

The Bahrain-based Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) plans to upgrade accounting standards and regulatory guidelines designed to maximize the investment potential of the estimated $1 trillion in worldwide assets in specialized sharia endowments (awqaf), which are primarily focused on mosque projects and global Islamization programs.

-

Saudi Arabia Issues Country’s First Global Islamic Bond

April 19, 2017

Pressured by collapsing oil revenues and falling currency reserves due to the country’s move to diversify its oil-dependent economy, the Saudi Arabian government has turned to international capital markets for debt relief, raising $9 billion with the Wahhabi Kingdom's first-ever Islamic bond issue.

-

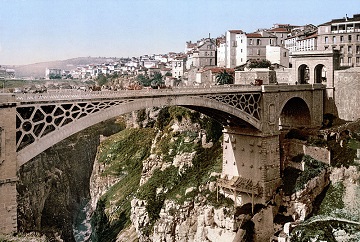

Algerian Government Reluctantly Moves Towards Islamic Banking

April 19, 2017

Algerian financial officials are moving reluctantly, given concerns stemming from the country's 1990's civil war between Islamists and secularists, to introduce sharia-compliant banking services as a way to offset the country's drop in oil revenues.

-

UK Central Bank Develops Sharia Options for Retail Banking

April 12, 2017

The Bank of England is working with the UK's five Islamic banks to develop options for sharia-based retail banking services that would comply with Islamic financial bans on the use of interest as London seeks to retain its status as an international financial hub following the UK’s exit from the EU.

-

Indonesian Brits Promote Sharia Finance in UK

March 27, 2017

The Indonesian Sharia Economic Community in the UK is actively promoting sharia compliant/compatible economic practices as part of a strategy to organize Indonesians in Europe to promote the integration of Islamic finance into Western economies.

-

Islamic Finance Broadens in US

March 15, 2017

The presence of Islamic finance in the US is broadening and deepening with a steady rise in the number of institutions providing sharia-compliant services and products in the areas of neighborhood revitalization, real estate investment, and customized academic programs on Islamic finance.

-

Islamic Finance Continues Expansion into Africa

March 08, 2017

The growth of sharia-compatible/compliant finance methods and banking services on the African continent continues apace as Morocco's Central Bank approved a range of Islamic banking services designed to grow investment and liquidity.

-

World Bank, OIC Seek Expansion in Islamic Finance

February 23, 2017

The World Bank Group and the Organisation of Islamic Cooperation's (OIC) Islamic Development Bank have published a Global Report on Islamic Finance calling for the expansion of sharia finance to contribute to the global "fair and equitable distribution of income and wealth" and the achievement of the UN's Sustainable Development Goals.

-

IMF Takes Closer Look at Risks of Islamic Finance

February 22, 2017

The International Monetary Fund (IMF) is incorporating Islamic finance into its surveillance framework for monitoring and assessing its member-countries' economies, with particular emphasis on providing technical assistance and advice on the high-risk hybrid products that are a growing part of the $2 trillion-worth of sharia-compliant/compatible assets worldwide.

-

Sharia Banking Grows in UK Financial Markets

February 08, 2017

UK banking officials report that sharia-compliant/compatible banking has grown aggressively as part of the country's total financial sector, by over 400% since 2012, driven by British officials' bid to make London a global Islamic finance capital and by strong migration flows to the UK from Muslim-majority countries.

Copyright 2026 Global Governance Watch. All Rights Reserved.

A project of The Federalist Society for Law & Public Policy Studies