-

Islamic Finance Expands Across Africa

November 30, 2018

Sharia-compliant/compatible finance is expanding rapidly across Africa, fueled by debt demand to support infrastructure and development needs and by the rapid growth of Africa's Muslim population that is largely unbanked.

-

Saudi Arabia Raises $2 Billion in Islamic Bonds

November 29, 2018

Saudi Arabia completed its external funding requirements for 2018 by raising $2 billion in Islamic bonds, a transaction aiming not only to cover the Islamic theocracy's budget deficit caused by lower prices in international oil markets, but also to reinforce the country's commitment to the global development of sharia-compliant financing instruments.

-

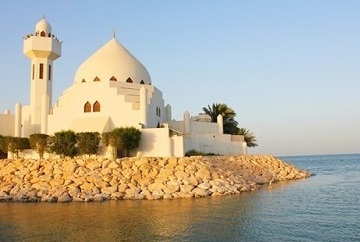

Islamic Banking Conference Focuses on Sustainable Growth

November 28, 2018

The Islamic theocratic kingdom of Bahrain announced that it will host the 25th annual World Islamic Banking Conference in November this year, convening the world’s largest gathering of Islamic finance and banking experts to discuss the theme “Islamic Finance & Sustainable Economic Growth in the Age of Disruption.”

-

Global Islamic Banking Assets Reach $1.69 Trillion

November 28, 2018

Data from the 21 countries comprising 95 percent of international financial activity in sharia-compliant/compatible assets and instruments indicate that global Islamic banking assets have now reached $1.69 trillion.

-

Proposed Digital Exchange Aims to Grow Islamic FinTech Business

November 28, 2018

A Dubai-based firm has filed an application in Malta to license a new digital exchange aimed at growing the Islamic finance market by allowing for trade in sharia-compliant/compatible cryptocurrencies, stocks, and commodities.

-

Moody’s Predicts Exponential Islamic Banking Growth in Africa

September 26, 2018

Credit rating group Moody's Investor Service projects that Islamic financial and banking services will experience rapid growth across the African continent over the next five years, given the cultural affinities of sharia-compliant/compatible finance with the estimated 40-percent Muslim population in Africa.

-

Islamic Home Financing in Indonesia Leads to Segregation

August 30, 2018

The effort of Indonesian banks to increase sharia-compliant/compatible financing for home mortgage and housing developments is leading to segregated, faith-based residential areas that are aggravating social cleavages and creating pressures against non-Muslim minority communities in the country.

-

Islamic Finance Leaders See Opportunities in Belt & Road Initiative

August 08, 2018

Islamic finance leaders view China's Belt & Road initiative to develop maritime and land connectivity on the Eurasian supercontinent as an opportunity to integrate sharia-compliant financial instruments and principles into the geopolitical infrastructure of Eurasia.

-

S&P: Sharia Indices Outpace Conventional Indices

August 01, 2018

Standard & Poor’s (S&P) global financial services and credit rating agency reported that sharia-compliant/compatible performance indices for the second quarter of 2018 outperformed conventional equities markets, with comparative gains in both US and Middle Eastern markets.

-

Islamic Banks Struggle with Standardization, Digitization

July 23, 2018

Islamic banks using sharia-compliant/compatible practices and products are rushing to grow their trade finance footprint by replacing global banks engaged in de-risking strategy but are encountering challenges in standardizing regulatory practices and using digitization tools to promote the reliability and growth of Islamic trade finance.

Copyright 2026 Global Governance Watch. All Rights Reserved.

A project of The Federalist Society for Law & Public Policy Studies